Return on cost calculation real estate

Your cash on cash would be 1000010000010 and your return on cost would be 1000010000010. This is a rule for purchasing and flipping distressed real estate for a profit which states that the purchase price should be less than 70 of after-repair value ARV minus repair costs rehab.

Internal Rate Of Return Investing Real Estate Investing Cash Flow

Depending on your investment goals this may be sufficient.

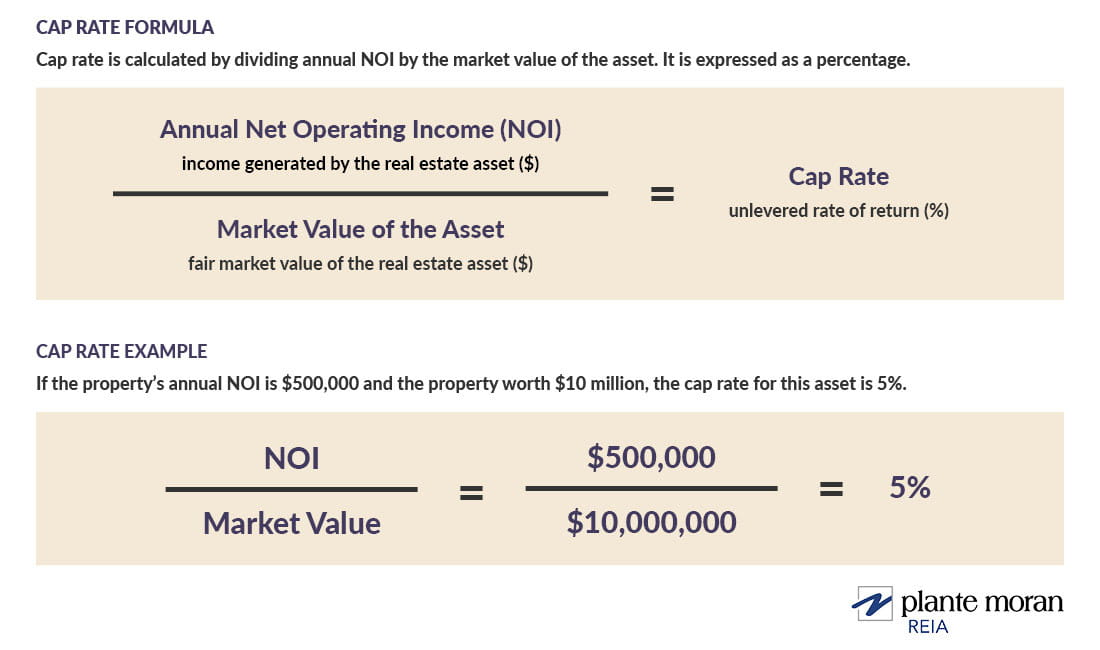

. This Real Estate ROI calculator will allow you to determine the return on your real estate investment in just a few seconds. It calculates the return value on real estate investments comparative to the cost of cash invested. To calculate it simply divide the net operating income by the projects total cost.

Input Investment Details Amount. The standard costs of the home sale transaction paid at closing. So in this case the real estate investors total ROI is 500000 divided by their total cost of 1250000 or 40.

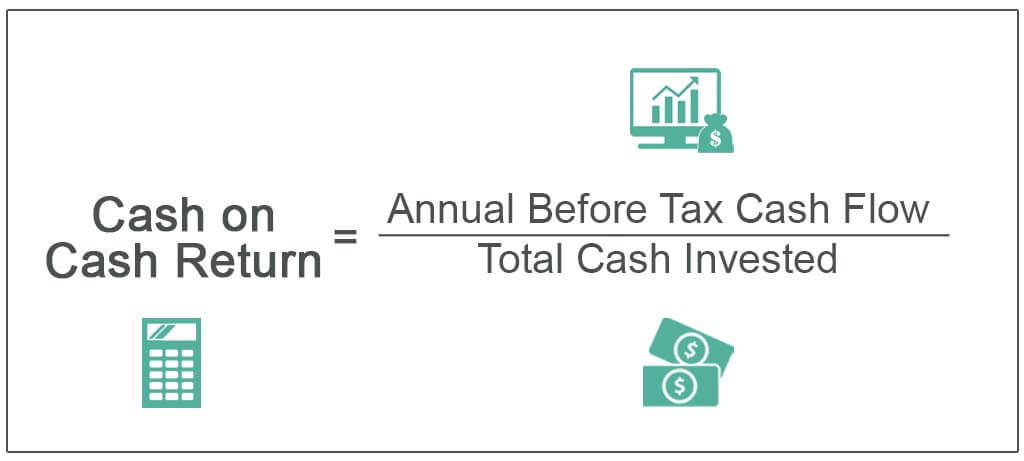

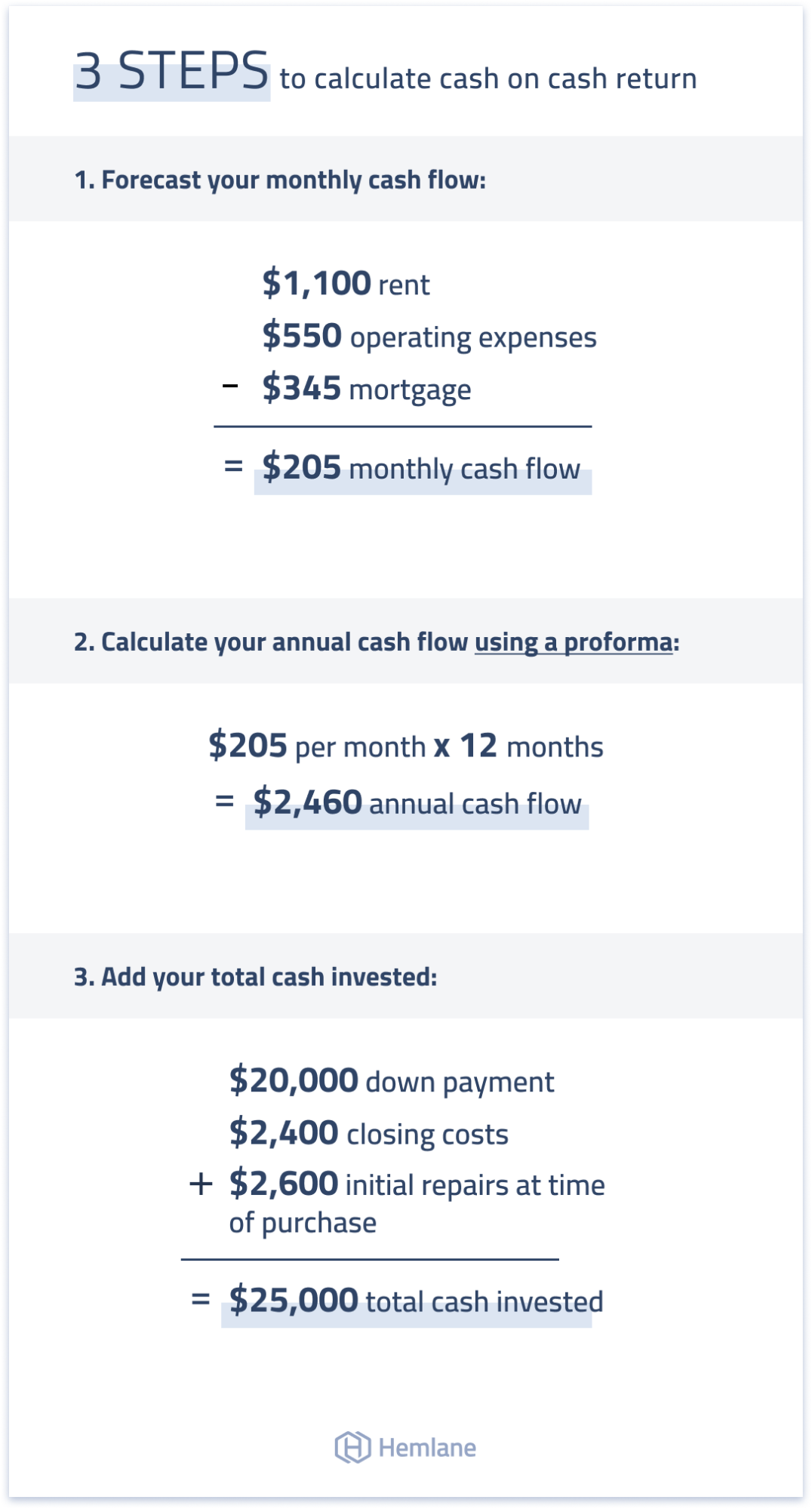

Thus in an unlevered investment theyre the same. There are two ways to calculate cash-on-cash return on a real estate investment. Yield calculations in real estate investing include.

This may be an overly simplistic calculation and does not account. Yield on Cost Commercial Real Estate Formula Yield on Cost Net Operating IncomeTotal. ROI is always calculated in percentage.

The cash on cash return calculator has a mortgagefinancing field that a real estate investor has to fill out. ROI includes all the taxes debt etc. Most commonly people simply divide the annual net cash flow over their initial cash.

The simple holding period return ie simple - meaning ignoring time value of money is the simplest real estate return calculation and what most people think of when return comes to. To calculate the propertys ROI. Enter investment details below including the initial investment amount hold period IRR and cash on cash return to calculate a deals potential returns.

Percentage representation of agentCommissionInput. Capitalization Rate Cap Rate Cash-on-Cash Returns. Divide the annual return by your original out-of-pocket expenses the downpayment of 20000 closing costs of 2500 and remodeling for.

Start by entering the following information into this free. First you set your investment property financing method cash.

Calculate Return On Investment For A Rental Propertyhttps Iqcalculators Com Calculator Real Estate Investing Financial Calculators Investment Companies

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

The Beginner S Guide To The Cap Rate Calculation In Real Estate Buying Investment Property Buying A Rental Property Investment Property For Sale

How To Calculate Cash On Cash Return The Method And Formula Rental Property Investment Real Estate Investor Investment Analysis

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

Cash On Cash Return A Beginner S Guide Propertymetrics

Cash On Cash Return A Beginner S Guide Propertymetrics

How To Calculate Roi On A Rental Property To Find Great Investments Real Estate Investing Investing Real Estate Investing Investment Property

Using The Cash On Cash Return In Real Estate Analysis A Cre

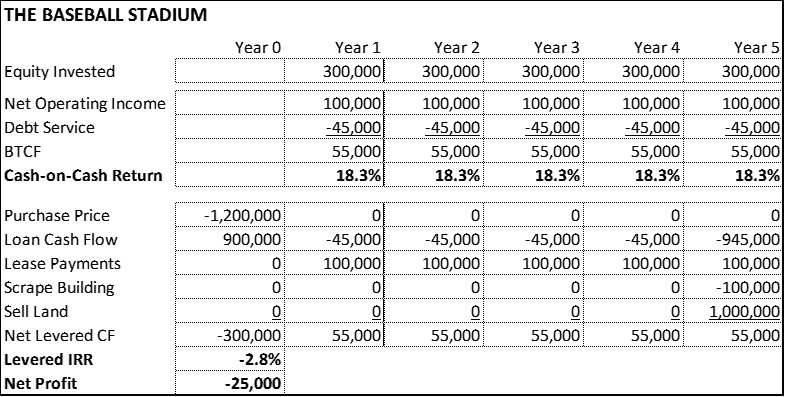

Real Estate Calculator Use Irr To Find Profits Arborcrowd

Cash On Cash Return Calculate Cash On Cash Return In Real Estate

What Is Accounting Rate Of Return In Commercial Real Estate Leverage Com

Return On Investment Roi Roi Accounting Investing Return On Assets Economy Lessons

Return Metrics Explained What Is A Cap Rate In Commercial Real Estate Our Insights Plante Moran

Why Cash On Cash Return Matters To Real Estate Investors In 2021

حساب العائد على الاستثمار Roi وكيف تقيس أرباحك Investing Video Marketing Strategies Investors Business Daily

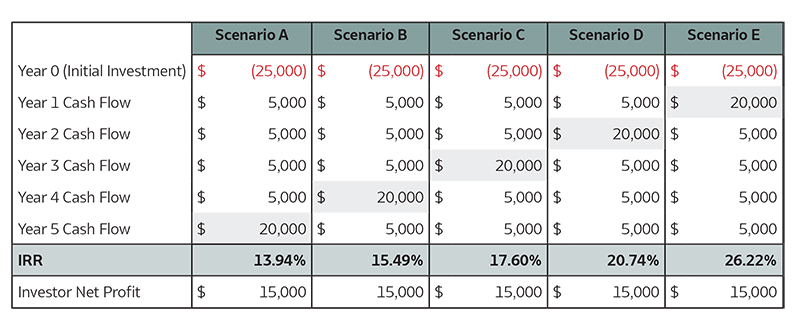

Internal Rate Of Return Irr Formula And Calculator